The market for gifts of vouchers and memberships

December 2024

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Themes

We’ve seen that gifts of vouchers to visitor attractions and memberships for heritage organisations, are seen as ‘good presents’, and that vouchers for a range of culture and leisure organisations have become more popular in recent years. But who is the market for them?

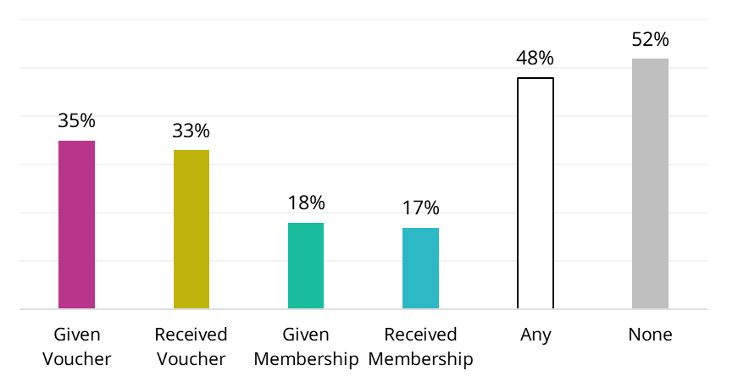

Overall, we can see that about half of the population have either given or received one of these types of presents in the last five years (or both). So, the potential market is quite broad.

The 52% who haven’t are more likely to be older (60% of 45-64s, 67% of 65+) and from (often older) medium-to-lower engaged segments (Home & Heritage 55%; Up Our Street and Frontline Families 57%; Supported Communities 73%) and in the North (59%), as well as those who are retired or ‘economically inactive’ (65%).

This means that the 48% who have given or received these gifts are more likely to be younger (63% of 25-44s) professionals (63% of senior management, 55% of middle management, 47% of traditional professions) who work from home (62%), with higher educational attainment (69% of those with an MA or higher, 55% a degree), dependent children (67%), particularly from higher-engaged segments (e.g. 64% of Metroculturals).

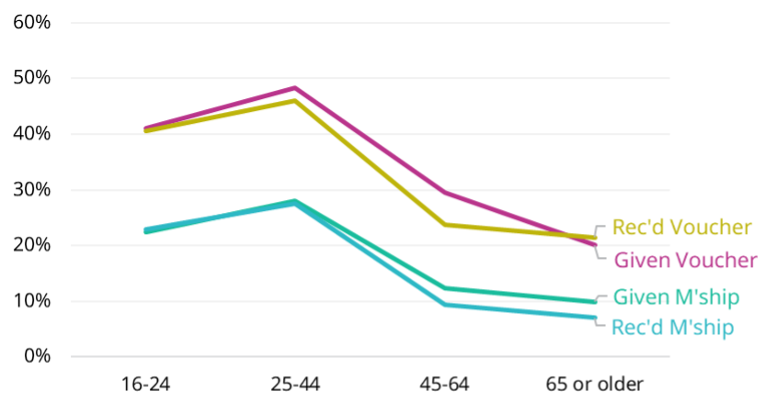

Looking at those who’ve given each, or received each, the profiles are similar. For example, by age:

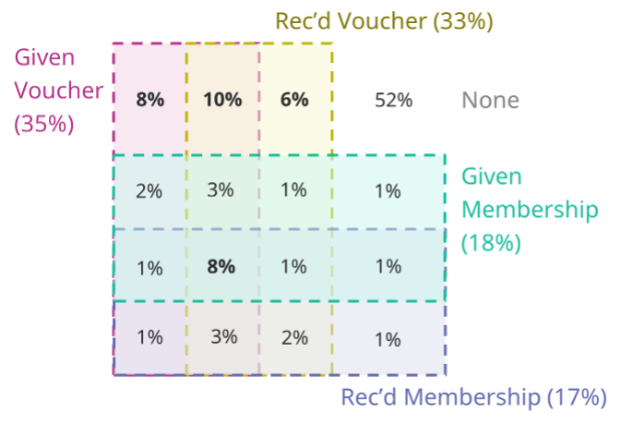

All are highest for 25-44s, dropping to their lowest for those 65+. But a more interesting picture emerges when we look at the most common combinations, as shown by the following Venn diagram. This breaks respondents out into the 16 possible combinations of answers, with the four largest groups highlighted:

These are:

- Has given a voucher only (8%)

- Has both given and received a voucher, but neither given nor received membership (10%)

- Has received a voucher only (6%)

- Has both given and received both vouchers and memberships (i.e. all four) (8%)

Together these account for 32% of all people, or 2/3 of those who had given or received either.

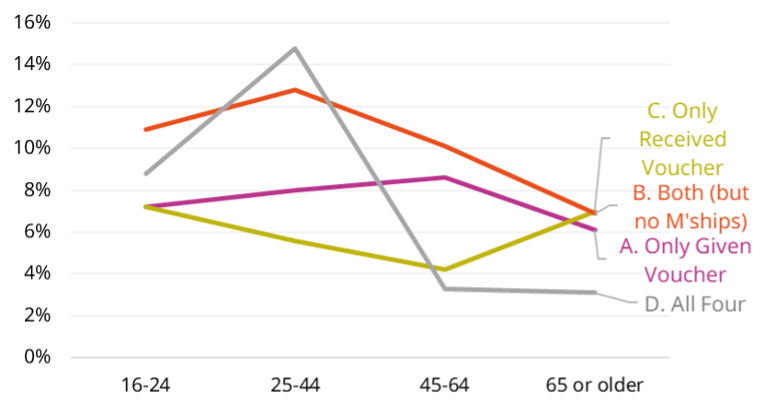

In these cases, each follows a strikingly different profile by age. Those who have both given and received vouchers follows a similar trajectory the overall picture, with greatest concentration among 25-44s. But those who have done all four is much more heavily concentrated on the 25-44s (to the extent of being highest of the four categories, whilst it’s the lowest for the 45-65s and 65+). Those who have only given vouchers are most likely to be 45-64; those who have only received them either 16-24 or 65+: the two lines are the inverse of each other.

This suggests that the higher figures for each type of gift given or received among 25-44s is particularly about a small (c. 1 in 7) who are doing all four things. This small group appears to have a greater level of giving and receiving of these types of gift, beyond just their higher propensity to do each. Those who have done all four things are particularly likely to be 25-34 (17%, cf. 8% overall), as well as to have children (17%; 20% of those with 6-10 year olds) and especially families who are feeling more affluent than a year ago (33%) and/or who live in urban areas (17%). Those in senior management roles (20%) and with higher educational attainment (MA+, 17%) are also more likely to be in this group.

This concentration in these groups highlights the profile of the key target audience. It also offers a suggestion that there may be different types of values or social relationships that underly the difference in extent as well (e.g. perhaps greater reciprocity of gift-giving).

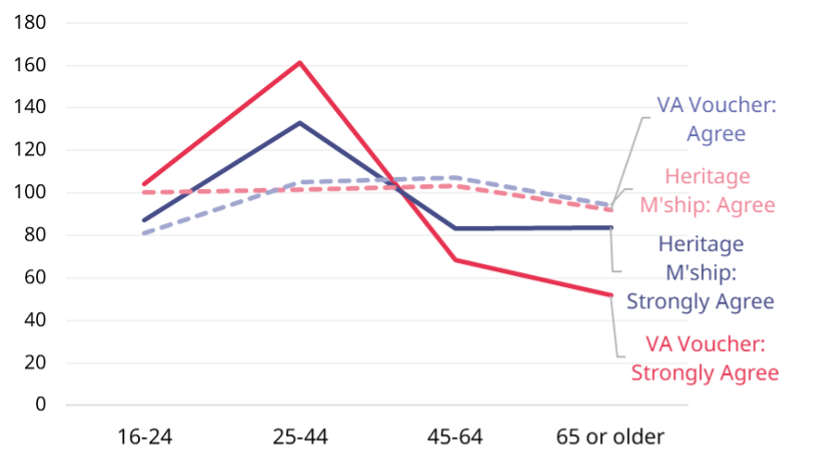

This is emphasised by looking at the attitudes to whether visitor attraction vouchers or heritage organisation membership are ‘good presents’ by age, compared to the overall result (indexed to 100):

What is notable is that the proportion ‘agreeing’ is little different to the overall figure among 25-44s: it’s a minority of about one in five who ‘strongly agree’ who make a difference.

These attitudinal differences suggest that as well as influencing who to target, this insight could also mean that different messaging would be useful when selling vouchers and membership to this group. More qualitative (and/or attitudinal) research, as well as user testing, would be needed to explore this further. But this evidence gives strong indications of where we should be focusing to grow these types of offers.

Related videos

Cultural Participation Monitor | Latest Findings on Audience Attitude and Behaviours

Watch nowTEA Break: Bad behaviour? - What types of behaviour people prefer when attending culture

Watch nowTEA Break | From Interest into Action

Watch nowTEA Break | More Insights on Changing Audiences

Watch nowTEA Break | Key Changing Audiences for Art Forms

Watch nowOther findings from Wave 11 | Sep 2024 | Gifts of memberships/vouchers, print/digital, museums

-

Are vouchers and memberships good presents?

In this article we explore how likely people are to appreciate vouchers and memberships as presents, and which groups to target with them.

-

Flatliners

Are audience numbers finally on the move…?