Cost of living crisis

September 2022

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Contents

Themes

The vast majority of respondents say that they are worried about the effects of the cost-of-living crisis on them and their household, with a whopping 92% intending to scale back on entertainment spend outside of the home as a result, especially among mid-engaged, middle-aged and less urban groups.

Who is most concerned

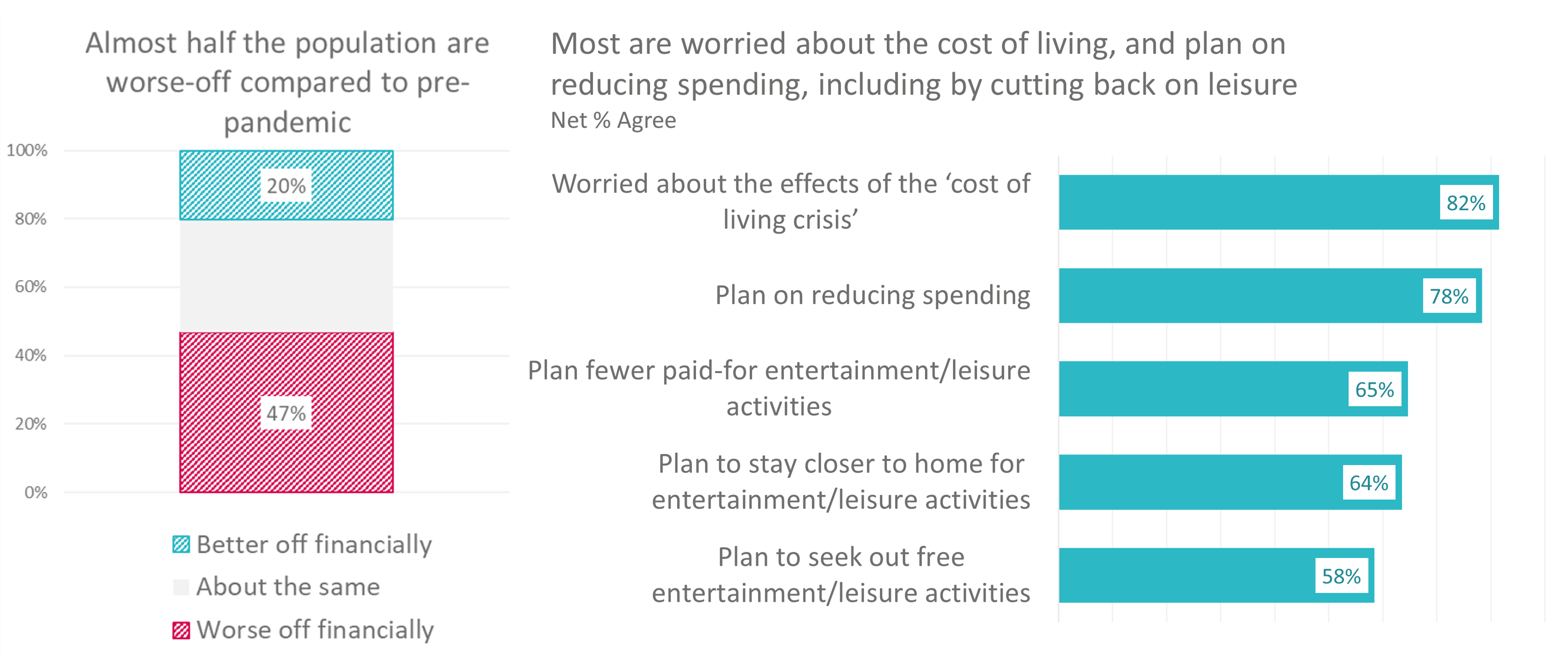

Almost half of people say that they are worse off now than they were pre-pandemic, and 81% are worried about the effects of the cost-of-living crisis on themselves and their households.

Those who ‘strongly agree’ that they are worried about the cost-of-living crisis are more likely to be: women (51%); 25-55 years old (52%); those with children (53%); and disabled people (56%).

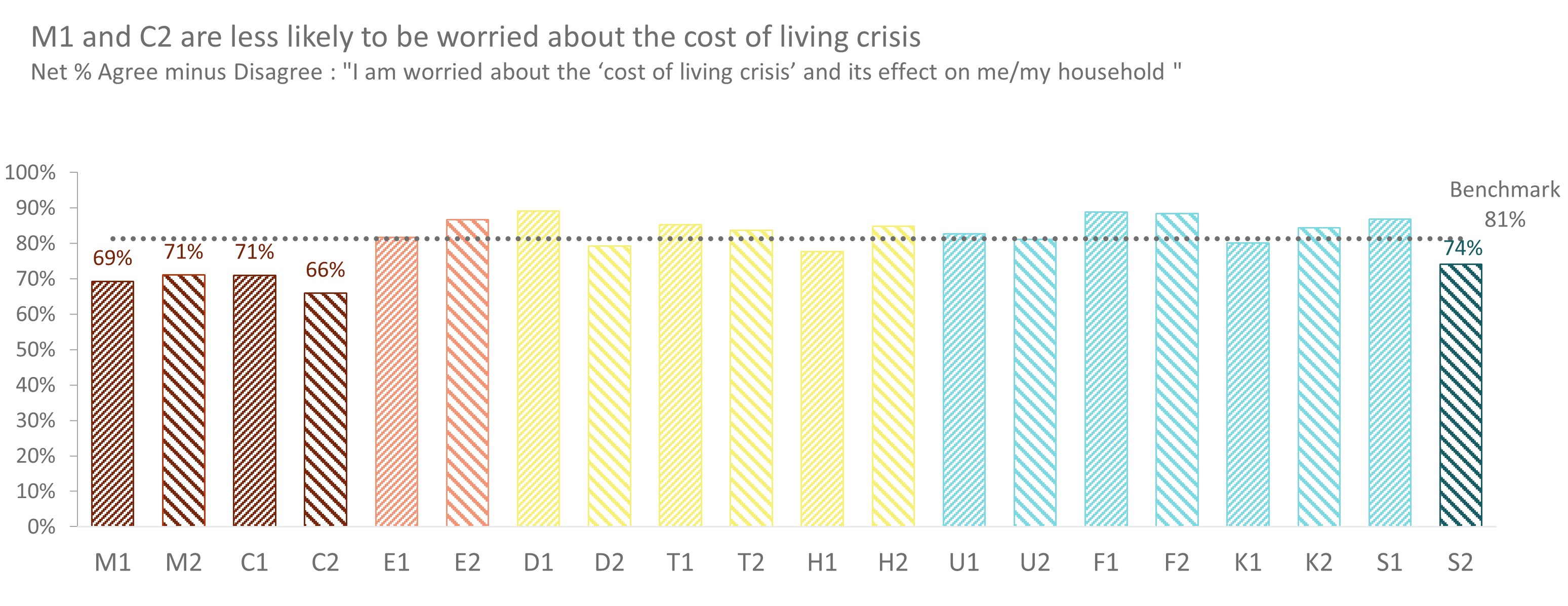

- Metroculturals and Commuterland Culturebuffs are slightly less likely to be worried about the cost-of-living crisis, as are retirees, only 30% of whom ‘strongly agree’ that they are concerned about its effect on their lifestyle.

- Typically mid-to-low engaged Audience Spectrum segments are the most concerned about the impact of cost-of-living, with family and less urban groups expecting to reduce out-of-home entertainment spend the most.

Concerningly, the Audience Spectrum groups who returned disproportionately strongly to in-person arts attendance over the past year, are now the ones saying that they expect their leisure spend to be hit the most by the cost-of-living crisis.

- This poses a potential threat to the sector's post-Covid recovery, which has so far fared better than many feared.

- This crossover is most notable for Frontline Families, Trips & Treats, Dormitory Dependables, and Experience Seekers.

How people expect to scale back

People are more likely to feel worse off (46%) than better off (21%) compared with before the pandemic and are worried about the impact of the cost of living crisis:

Breaking this down a bit further by spending intentions, we find that:

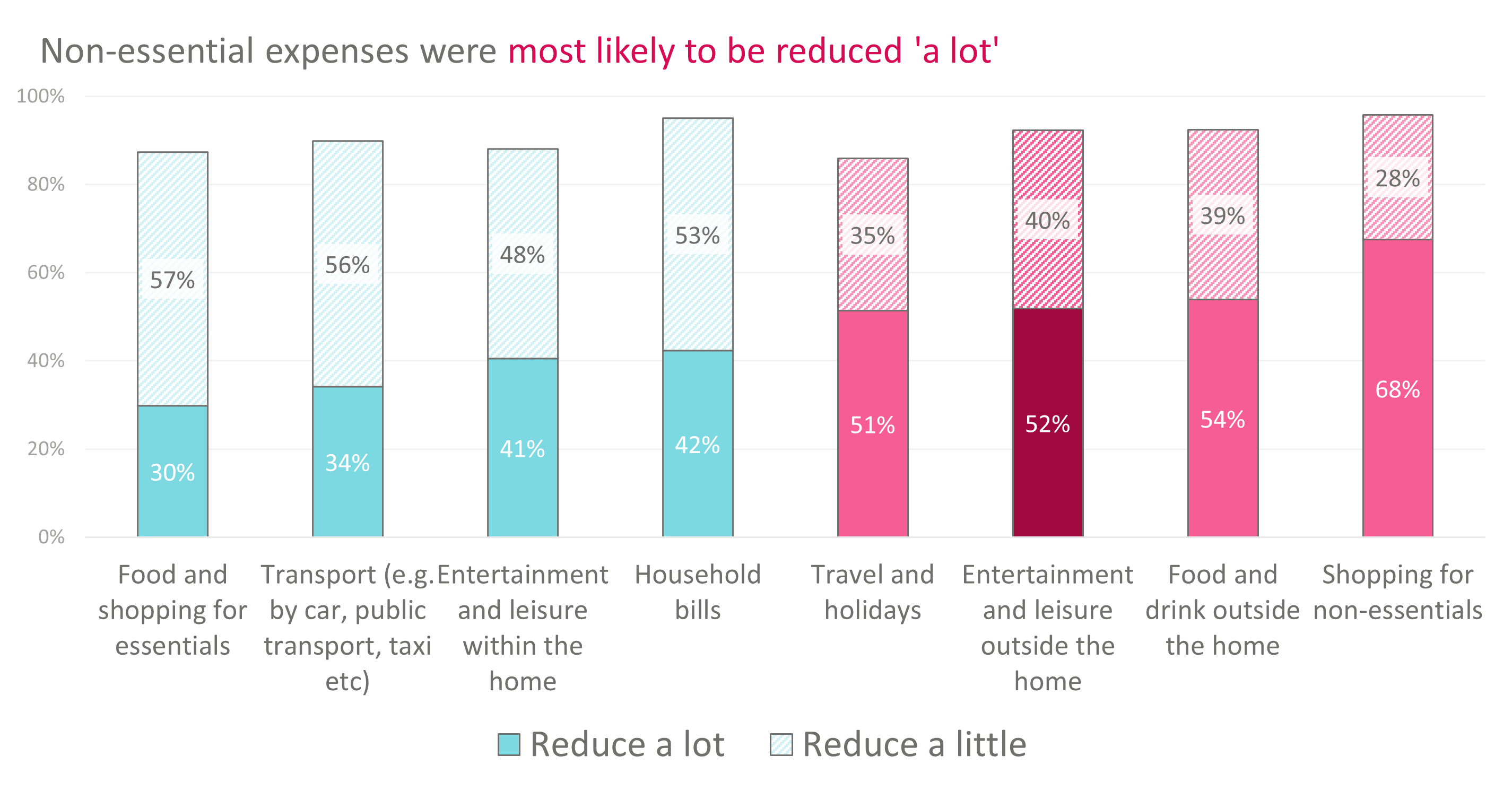

- 92% expect to reduce their spend on ‘Entertainment outside the home’ to some degree as a result of the cost of living crisis, and over half anticipating that they will do so ‘a lot’.

- A 57% majority say that they expect to spend less on entertainment and leisure compared to before the pandemic: 27% think it will reduce ‘a lot’.

- This reduction is especially high for middle-engaged groups and middle-aged, non-London and rural respondents.

We also asked respondents whether they intended to ‘reduce spending a lot’, ‘reduce spending a little’ or ‘not try to reduce’ spending across a range of categories:

At 52% saying they would cut spending 'a lot' on ‘Entertainment and leisure outside the home’, this was the third-highest grouping of activities for cutting spending ‘a lot’.

- This was grouped along with ‘food and drink outside the home’ (54%) and ‘travel and holidays’ (51%).

- ‘Household bills’ and ‘entertainment and leisure within the home’ saw a lower reduction in the low 40s, while ‘transport’ and ‘food and shopping for essentials’ are the things people expect to cut back on the least.

- The competition between in-home and out-of-the-home entertainment and leisure is particularly notable, with the latter more likely to be squeezed.

At 68%, the only thing people said they expected to cut back spending on to an even greater degree was ‘non-essential retail’.

For a deeper dive into the impact of the cost-of-living crisis on arts culture and heritage, catch up with our TEA Break on this topic.

Related videos

Other findings from Wave 7 | Sep 2022 | Cost of Living, everyday participation, shops/cafés

-

Everyday creative participation

While financial uncertainty might make people nervous about splashing out on more expensive arts and culture activities, over 40% of people say that pursuing creative hobbies in their own time is a key interest, a trend that skews towards younger participants and has increased through the pandemic.

-

Ongoing Attitudes to Covid

Fears surrounding Covid-19 are softening, with half feeling 'back to normal' and fewer than 1 in 10 people expressing strong concern about catching the virus themselves, although over half still worry about vulnerable friends and family, while support for certain safety precautions remains high.

-

Plans for future attendance

While willingness to attend continues to trend upwards however, people do anticipate that their future in-person participation will be less frequent than pre-pandemic, though outdoor events are an exception, and they also intend to engage with cultural activities more locally (and inexpensively) than before.