The cost-of-living crisis and audiences’ attendance

July 2023

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Themes

The cost-of-living crisis continues to expand and impact individuals in the UK. The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 6.3% in the 12 months up to September 2023 according to the Office for National Statistics. It is affecting many individuals’ daily lives and is having an impact on engagement at cultural and arts events and on organisations’ income, at an already difficult time.

Here we look at how the cost of living is affecting different Audience Spectrum segments and age groups with regards to the amount of time and money they are spending on cultural and arts events.

Attitudes to Cost of Living

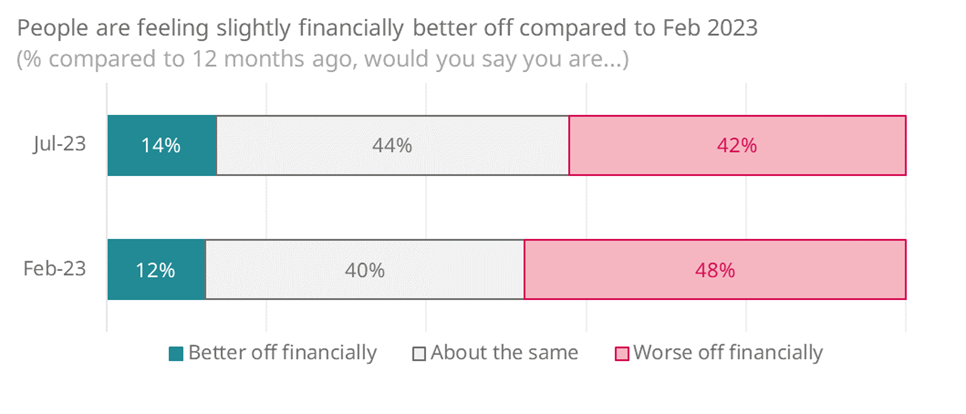

Many people stated that they are feeling worse off than 12 months ago. The proportion reporting attending less increased overall between February 2023 and July 2023, by 9%. However, those who consider themselves worse off financially decreased by 6% between February and July 2023. This suggests that income is recovering, but attendance is still lagging and indicates the financial instability in the UK.

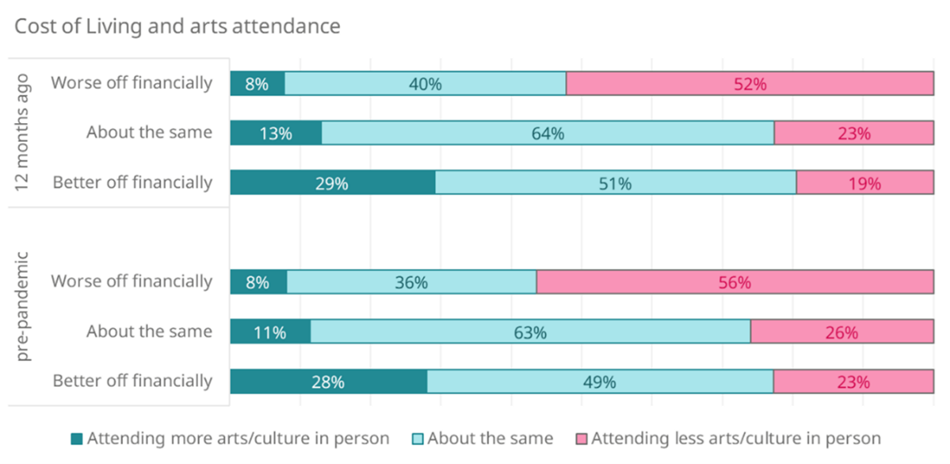

52% of respondents who consider themselves worse off financially also report attending less compared to 12 months ago, whilst 19% of people who are better off financially are attending less. This suggests that the cost of living is impacting attendance in different ways depending on the context of the individual.

There is overriding concern regarding the COL crisis and what it may potentially bring in the future. Currently 49% of people have not made changes to their attendance in the last 12 months, with 67% of people saying they plan to do fewer paid for entertainment activities going forward. Of those 67%, 86% are already reporting attending less over the last 12 months. This suggests that the cost of living crisis is continuing to drive lower engagement and there are implications for arts and cultural organisations due to attendance decreasing and different parts of the population looking to decrease their spending.

COL is driving lower engagement differently for younger and older audiences

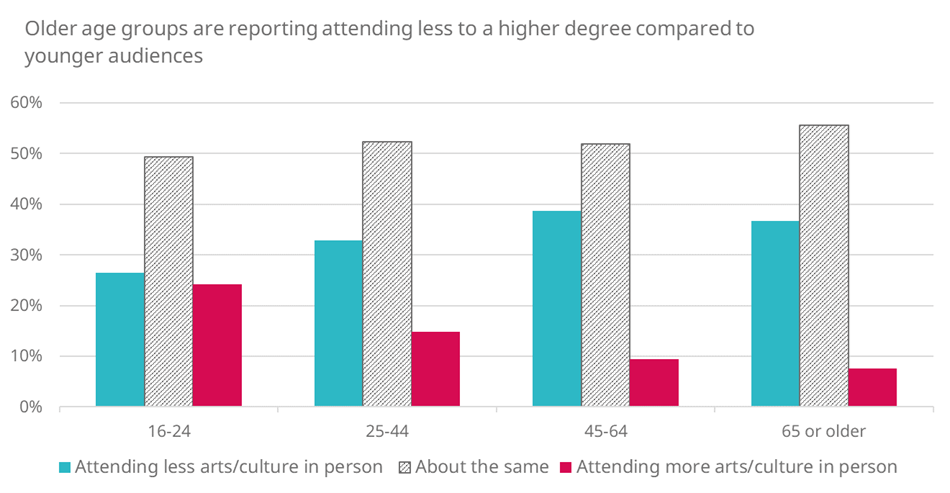

People are attending differently depending on age. A similar distribution of 16-24 year olds are reporting attending less (27%) as well as more (24%) over the last 12 months. However, 39% of 45-64 year olds and 37% of those aged 65 and over are reporting attending less compared to less than 10% of all over 45s who’ve said they are attending more in the last 12 months. This shows a big discrepancy between age groups and that older people are attending events less than younger.

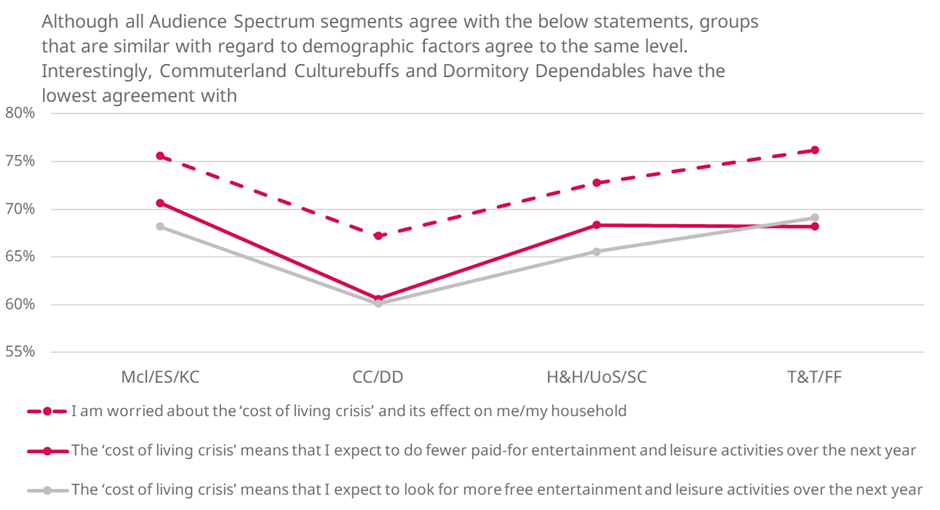

a. I am worried about the 'cost of living crisis' and its effect on me/me household

b. The 'cost of living crisis' means that I expect to do fewer paid-for entertainment and leisure activities over the next year

c. The 'cost of living crisis' means that I expect to look for more free entertainment and leisure activities over the next year

d. Changes to interest rates make a difference to how much money I spend on culture and leisure

e. Changes to energy rates make a difference to how much money I spend on culture and leisure

f. The overall rate of inflation makes a difference to how much money I spend on culture and leisure

g. The cost of living means I will take fewer days out to visitor attractions

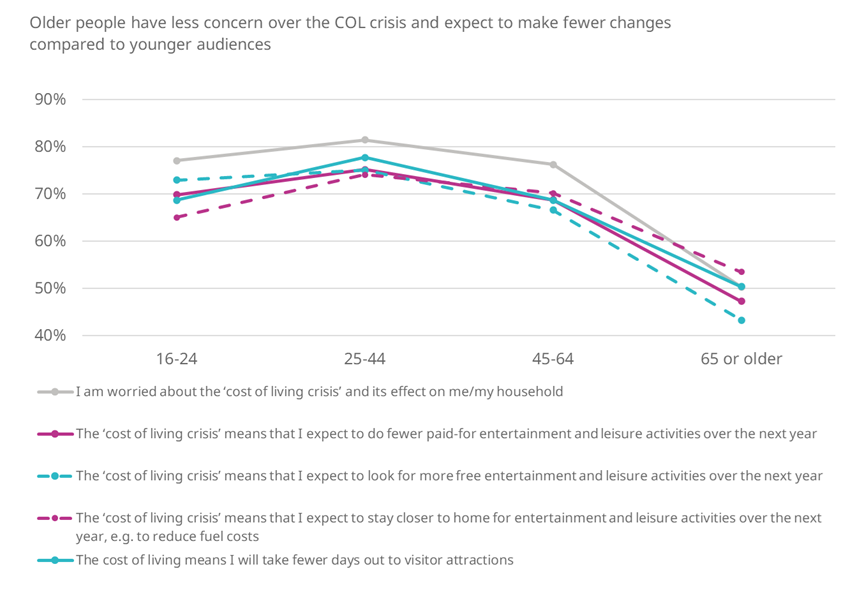

All age groups agreed with every statement, but to differing levels. Older age groups are looking to stay closer to home and look for more free entertainment. Similarly younger groups are also looking to reduce costs and are planning to do fewer activities. In general, those aged between 16-44 illustrate greater overall concern for the COL crisis, however, as noted previously younger people are not attending less events in comparison to older people and don’t plan to do less. This suggests that they are more strongly impacted by the COL, but don’t plan to spend or make a change to their lifestyle as a result of it.

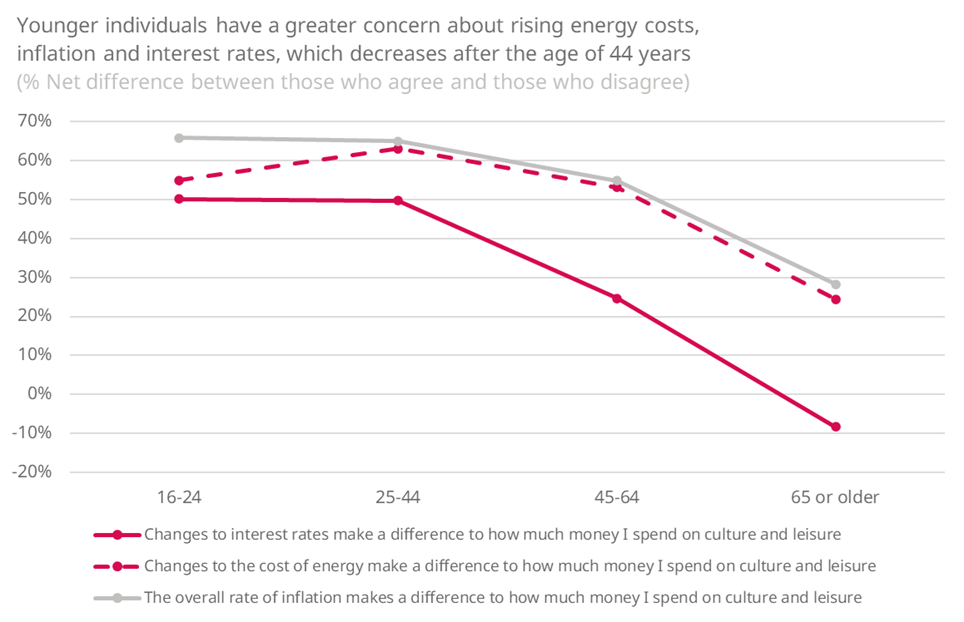

Those aged 45 and over are less likely to agree to statements on interest rates, energy costs and overall inflation compared to those aged under the age of 45. This suggests that although older people are reporting attending less, they are not feeling the pressure of rising costs as much as younger generations. This is particularly in relation to interest rates, potentially because they don’t have a mortgage (either because they rent or have paid their mortgage off) or are in a more financially stable position.

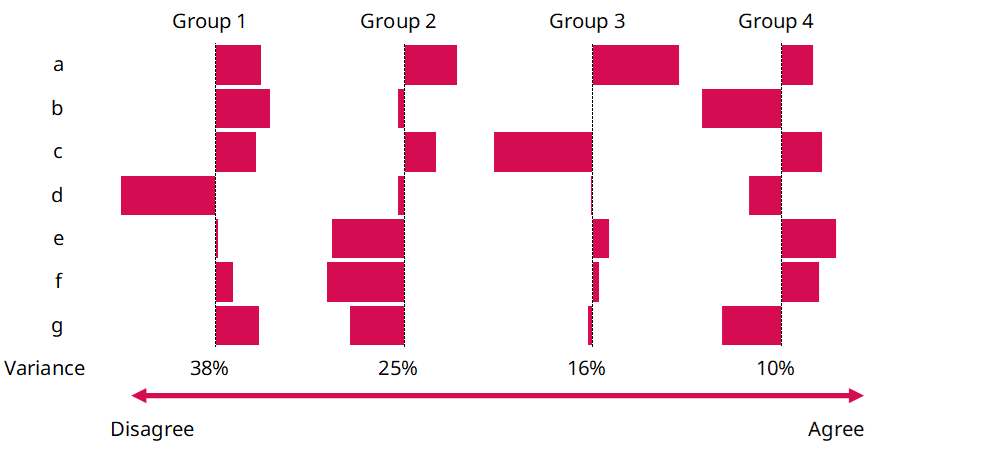

We can better understand the COL crisis and the level to which respondents are being impacted when considering which statements are frequently agreed with in combination. A pattern emerges, whereby four core cohorts of audiences’ preferences emerge:

Group 1: Non-mortgage payers who have a broad concern about COL and expect to do less leisure activities as a result.

Group 2: Concern for the COL but don’t plan to make any cultural changes.

Group 3: Already very pinched by living costs and going to continue as normal.

Group 4: Are worried about the COL crisis, however, they are not going to do fewer paid for activities but aim to spend less on them.

Interest rates and free entertainment are acting on age groups differently. Those aged 65 and over are more likely to identify with group 1. This possibly reflects that those aged 65 and over have likely paid off their mortgages or are close to doing so, and although the cost of living is still a concern, interest rates are not. In comparison, potential new buyers, who are often younger, have a much higher concern for this as interest rates more directly affect them.

Those aged 25-44 are more likely to fall into group 2 or 4 compared to other age groups; both of which are very concerned about the COL and don’t plan to make any changes to how they spend their time, except the latter aim to try and spend less money on events but not stop entirely.

All Audience Spectrum segments are feeling the financial pinch, but not all segments are planning to stop attending events

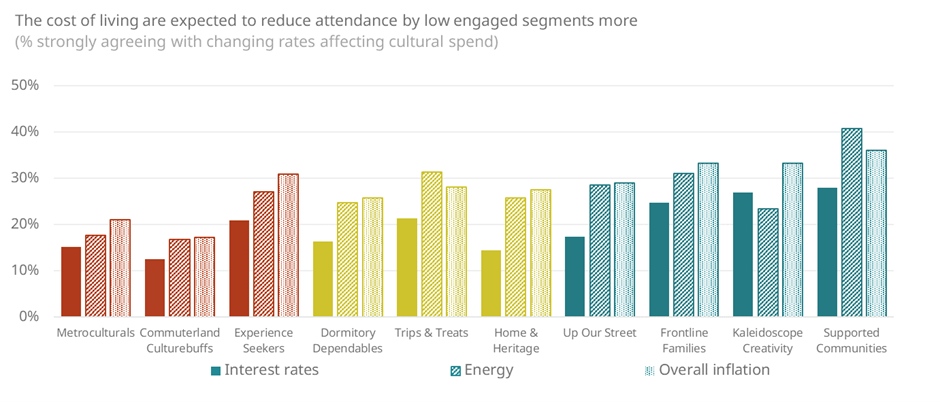

Like age, most Audience Spectrum segments feel that energy and overall inflation are causing greater concern and will have an impact on their spending. Supported Communities and Trips and Treats are more concerned with Energy rather than the overall inflation rate compared to other groups, whilst Kaleidoscope Creativity are more concerned about Interest rates.

Audience Spectrum segments who share similar demographic factors are expressing concern at the same level. Commuterland Culturebuffs and Dormitory Dependables are feeling the least pinched by the cost of living compared to other segments, whilst Trips & treats and Frontline Families are the most concerned.

Interestingly, when considering the Audience Spectrum segments in relation to the groupings for statements, Supported Communities are more likely to identify with group 3 in the analysis above (those that are already very pinched by living costs but going to continue as normal). All lower engaged segments are more likely to identify with group 4. However, middle engaged segments tend to fall in the middle for most groups, but least likely to fall into group 4 - they are somewhat split between continuing as normal and attempting to do less if possible. Finally, higher engaged groups are more likely to fall into group 1, despite age indicating that interest rates are a concern for younger audiences.

This suggests that higher engaged groups are worried about COL and plan to spend fewer days and money on culture and leisure, which is a concern for arts and cultural organisations. Lower engaged groups are also worried about COL but are not going to make any changes to their attendance or engagement levels, but perhaps try to spend less money in doing so if possible. This is potentially because lower engaged groups, although concerned, are less inclined to reduce attendance due to already being pinched by living costs prior to the COL crisis in comparison to higher engaged groups.

Related videos

Cultural Participation Monitor | Latest Findings on Audience Attitude and Behaviours | Wave 9

Watch nowOther findings from Wave 9 | Jul 2023 | Live/digital, social values. audience behaviour

-

Cost of Living

It’s no surprise that the UK population feel worse off than they did last year (33% feeling worse off, 49% about the same and only 18% better off, a net 15% reduction).

-

Audiences prefer live events to digital

This report uses data from wave 9 of the Cultural Participation Monitor (CPM) to understand the extent audiences engage with live versus digital events, finding that:

- All audiences prefer live events, followed by at home viewing and then watching at a cinema screening.

- Lower engaged segments are more open to viewing at home and at the cinema compared to higher engaged segments.

- Younger people are more open to all viewing platforms and artforms compared to audiences aged 45 and over

-

Audiences prefer live events, but how much varies by artform

Data from the CPM suggests that the more popular an artform is the more open audiences are to viewing it in different formats other than live. This report presents insights into how the popularity of an artform and the initial audience interest can determine how engaging people find non-live events for a particular artform.