Cost of Living

June 2024

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Themes

It’s no surprise that the UK population feel worse off than they did last year (33% feeling worse off, 49% about the same and only 18% better off, a net 15% reduction).

Indeed, 71% agree they are ‘worried about the cost-of-living crisis and its effect on [them/their] family’ and 49% say that their disposable income has decreased in the last five years (19% ‘a lot’ and 30% ‘a little’, only 27% saying it has increased).

Financial constraints appear to lead directly to reduced cultural attendance. Indeed, 61% agreed (23% strongly agreed, 38% agreed) that ‘the cost-of-living crisis means that I expect to do fewer paid-for entertainment and leisure activities over the next year’. Similar proportions (63%, made up of 24% strongly agree and 39% agree) also said that ‘the cost-of-living crisis means that I expect to look for more free entertainment and leisure activities over the next year’.

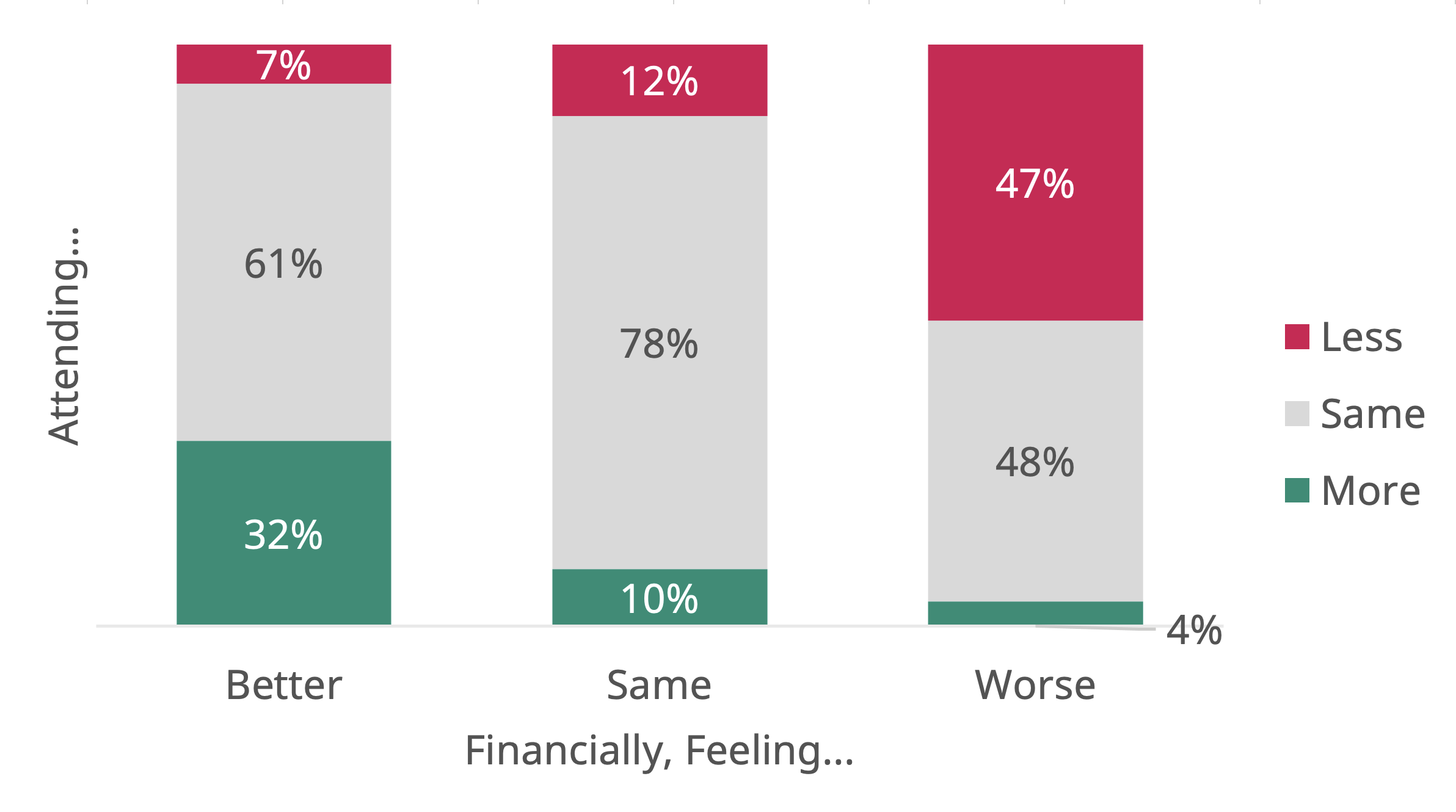

Moreover, there’s a direct link between those who are feeling better off (or worse off) financially than 12 months ago and those who are attending more (or less) compared to 12 months ago. Only 7% of those feeling better off are attending less; only 4% of those attending worse off are attending more. Conversely, 32% of those feeling better off are attending more and 47% of those feeling worse off are attending less.

In all three groups, the largest proportion of respondents were attending about as much as before, but this was only narrowly the case (within the margin of error) for those who were feeling worse off. Given that this group is a third of the overall population, the impact of the cost-of-living crisis on cultural engagement is clear.

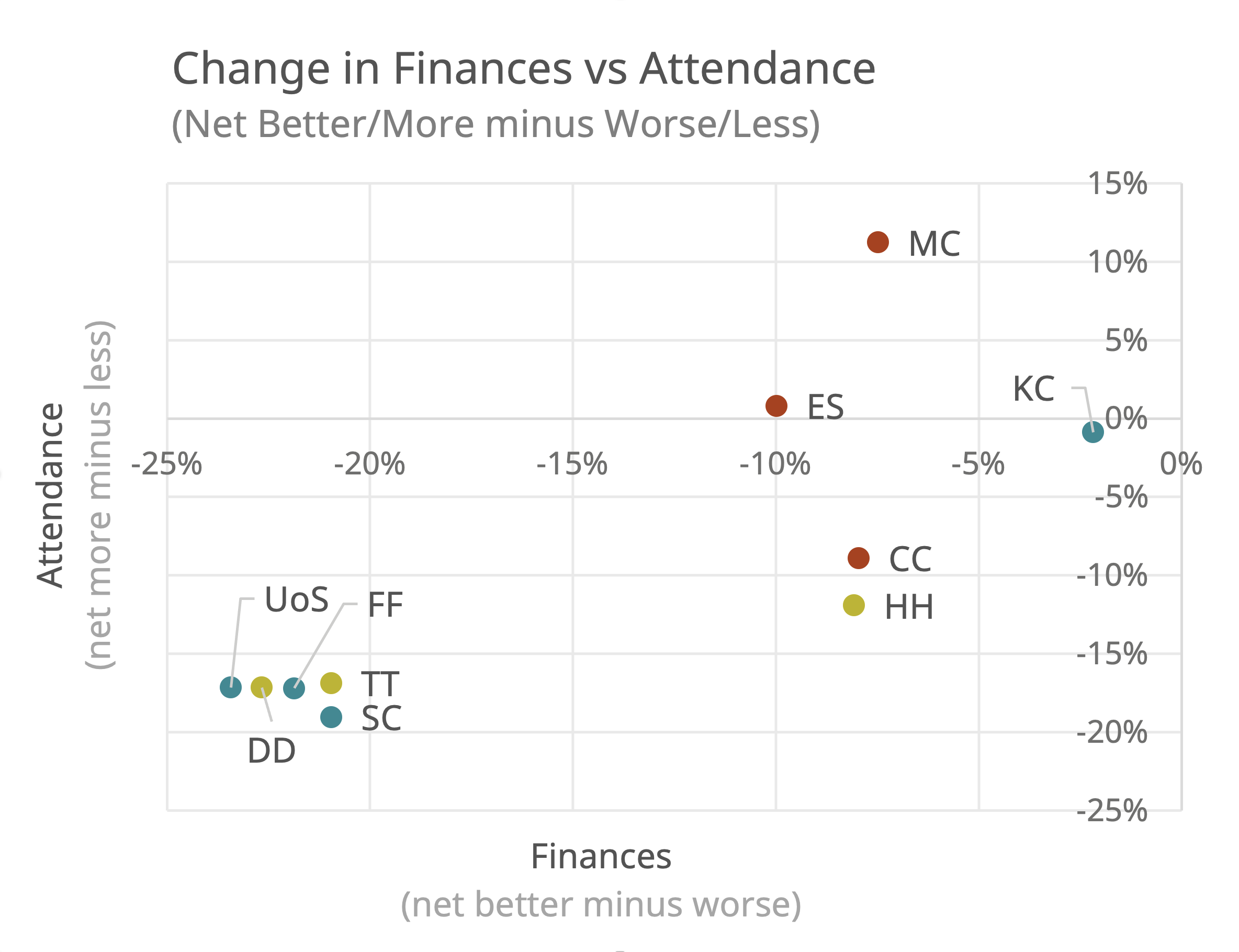

When looking at which groups are attending more or less, compared to how they are feeling financially, there is a split between three groups of Audience Spectrum segments:

- Urban / metropolitan groups (Metroculturals, Experience Seekers and Kaleidoscope Creativity) which are feeling a little less well off (net -10% and -7% respectively for the first two, with Kaleidoscope Creativity only slightly down on -2%) but are attending about the same (+/-1%, or net 11% more, for Metroculturals)

- Older medium-higher engaged groups (Commuterland Culturebuffs and Home & Heritage) which are feeling a little less well off (net -8%) and also attending less (net -9% and -12% respectively)

- All other (mid- and lower-engaged) segments, that are net -15% to -20% for attendance and net -20% to -25% for finances.

This suggests that the impact of the cost-of-living crisis is being particularly concentrated among family and middle- and lower-engaged groups, with reductions among older audiences driven mainly by different reasons (post-COVID changes).

(Note: source for all figures is the Cultural Participation Monitor wave 9, with fieldwork in March 2024, with a nationally representative sample of 2,945 UK adults. Samples by Audience Spectrum segment vary from 107 [Metroculturals] up to 472 [Dormitory Dependables]).

Related videos

Cultural Participation Monitor | Latest Findings on Audience Attitude and Behaviours | Wave 9

Watch nowOther findings from Wave 9 | Jul 2023 | Live/digital, social values. audience behaviour

-

Audiences prefer live events to digital

This report uses data from wave 9 of the Cultural Participation Monitor (CPM) to understand the extent audiences engage with live versus digital events, finding that:

- All audiences prefer live events, followed by at home viewing and then watching at a cinema screening.

- Lower engaged segments are more open to viewing at home and at the cinema compared to higher engaged segments.

- Younger people are more open to all viewing platforms and artforms compared to audiences aged 45 and over

-

Audiences prefer live events, but how much varies by artform

Data from the CPM suggests that the more popular an artform is the more open audiences are to viewing it in different formats other than live. This report presents insights into how the popularity of an artform and the initial audience interest can determine how engaging people find non-live events for a particular artform.

-

Audience preferences on venues' values

Social and environmental issues are at the forefront of much news about the cultural sector recently: cancellation of fossil fuel sponsorships; repatriation of museum artefacts and decolonialisation of collections and displays; demonstrations of support for Black Lives Matter; the emphasis on environmental action in Let’s Create and National Portfolio funding, to name but a few topics. But where is the voice of the audience in these discussions?