Cost-of-Living is hitting lowest engaged groups hardest

July 2023

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Contents

Themes

Cost-of-living fears still soar above receding Covid concerns as the driving factor behind declining attendance, though less so for settled suburban groups - meanwhile the already least engaged audiences continue to be most affected, compounding the existing inequality gap in cultural consumption.

Changes to Attendance

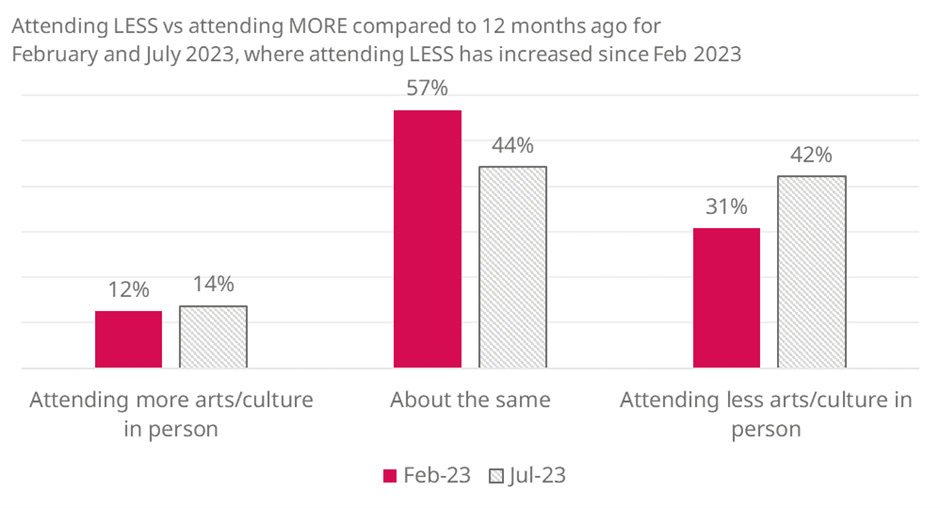

Overall, people are still attending arts and culture less than they were before the pandemic (38% attending less, but only 12% more), as well as less than they were 12 months ago (35% attending less and 13% attending more).

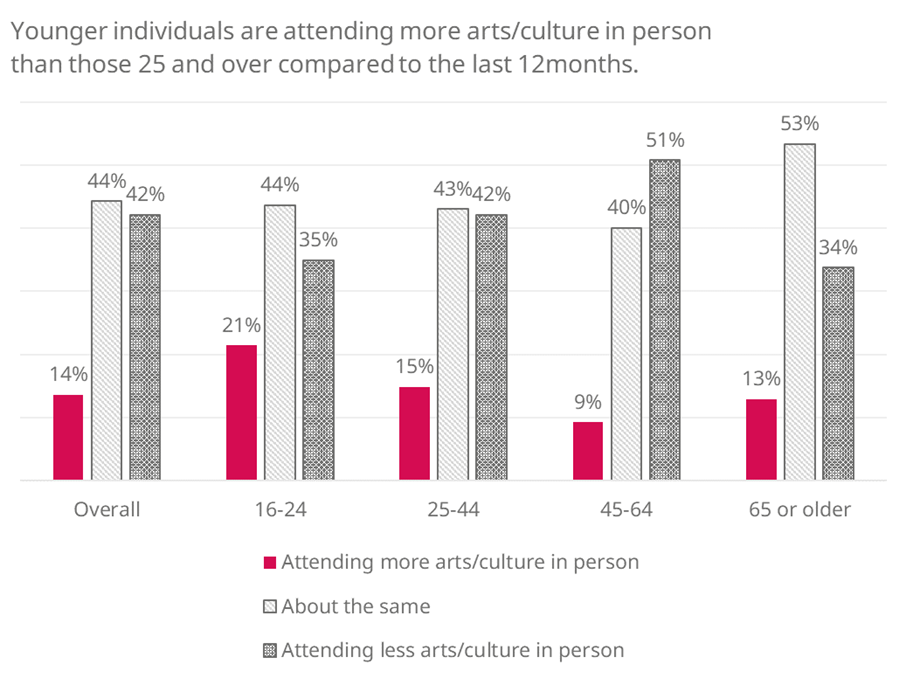

- While Gen Zs (16-24) in particular seem to be returning to near pre-pandemic levels of cultural activity, engagement has especially dropped for middle-aged groups since we last posed the question in February 2023.

- In fact, twice as many people (51%) aged under 44 have attended any arts and heritage event in the past 12 months than those between the ages of 45-65, only 25% of whom have done so.

Attitudes to Covid-19

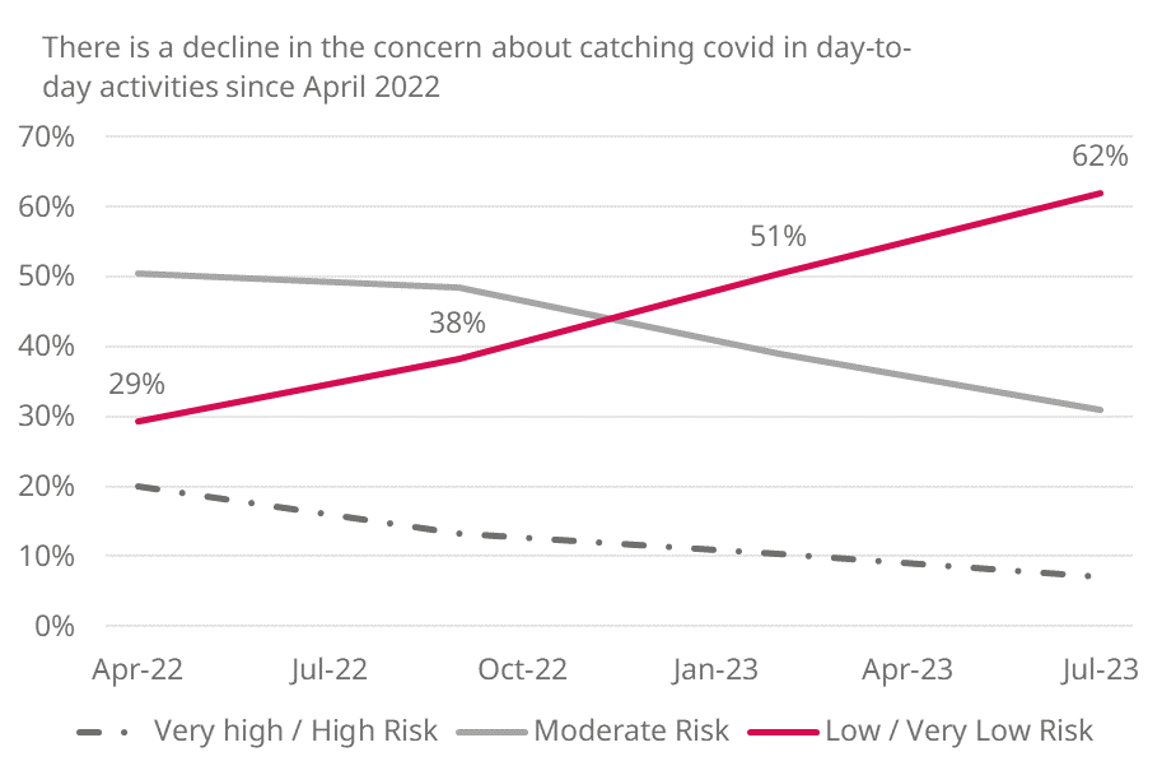

Covid-19 continues to recede as a perceived risk, with a majority (62%) now saying that they think the chance of contracting or passing it on in day-to-day situations is ‘low’ or ‘very low’ - an 11% increase on February 2023.

- Over half of individuals agreed or strongly agreed that ‘in the UK at least, the pandemic is effectively over’ - 55% compared with 34% in February - which suggests a notable shift in attitudes within just the past few months.

- Younger people are even more inclined to consider the pandemic a thing of the past, with 70% of Gen Z saying that we're now out of the woods.

- However, Covid-19 does still remain a factor inhibiting in-person arts engagement for between a fifth and a quarter of people.

- 21% agree (though only 5% strongly) with the statement ‘The risk of catching/spreading Covid-19 puts me off attending cultural events’ (compared with a far higher 59% for the cost of living).

- The level of perceived risk from Covid-19 in day-to-day activities is similar across all age groups, regardless of whether they are attending cultural events less or more in the last 12 months, than they were pre-pandemic.

Attitudes to Cost of Living

As of summer 2023, cost of living concerns are having a far greater effect on people's ability and intention to attend arts and culture than Covid fears, with 59% of people saying they are actively put off attending arts and culture by cost-of-living concerns.

- 42% of people are still feeling ‘worse off’ than before the pandemic, with a further 44% ‘about the same’, and, unsurprisingly, just 14% ‘better off’.

- This is largely unchanged since February (48%, 40%, and 12% respectively), suggesting that these are the kinds of of figures we can expect for the foreseeable.

- Overall though, the numbers of people already attending less arts and culture than they were a year ago has gone up significantly, from 31% in February 2023, to 42% in July, though the change is slower in younger groups.

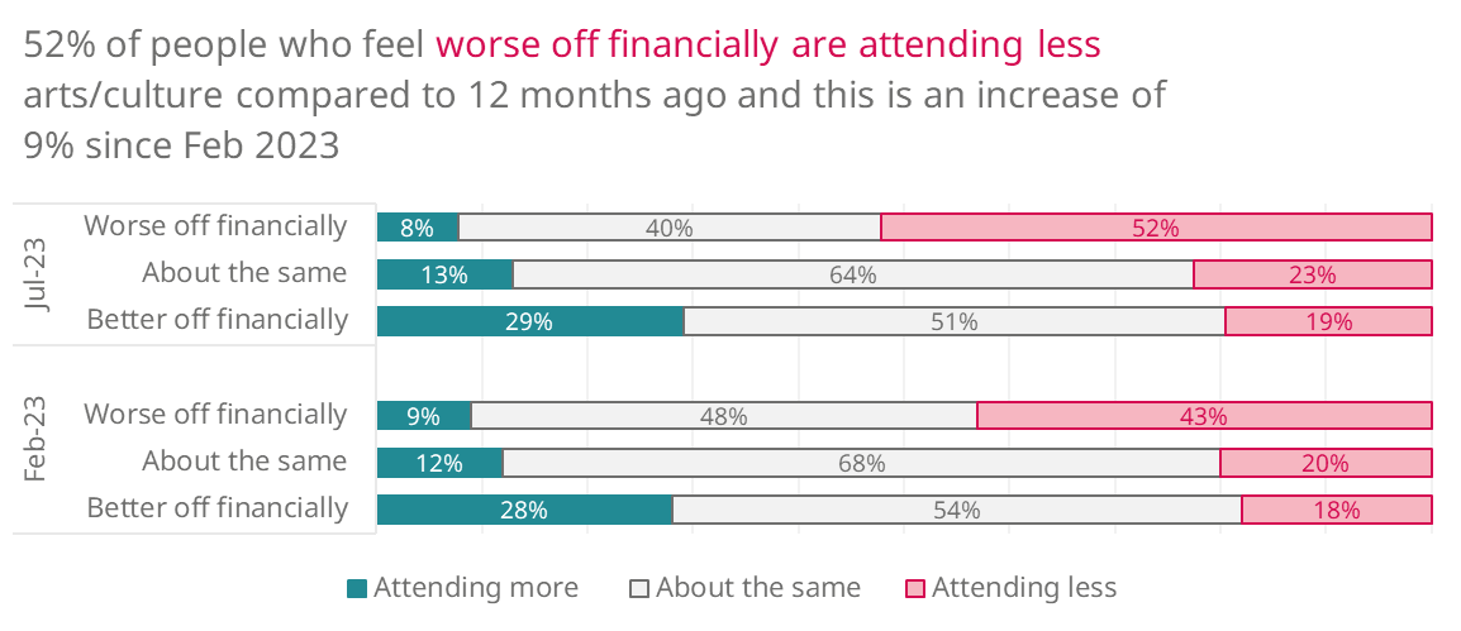

People who are feeling even worse off than they were this time last year are, understandably, reporting a steady decline in their arts and culture attendance - the number saying that they've been engaging less than they used to is up +9% (to 52%) in just the past 5 months.

- That said, 19% of people who say that they are actively choosing to attend fewer live cultural events these days actually consider themselves to be financially better off this year, so other factors remain at play as well.

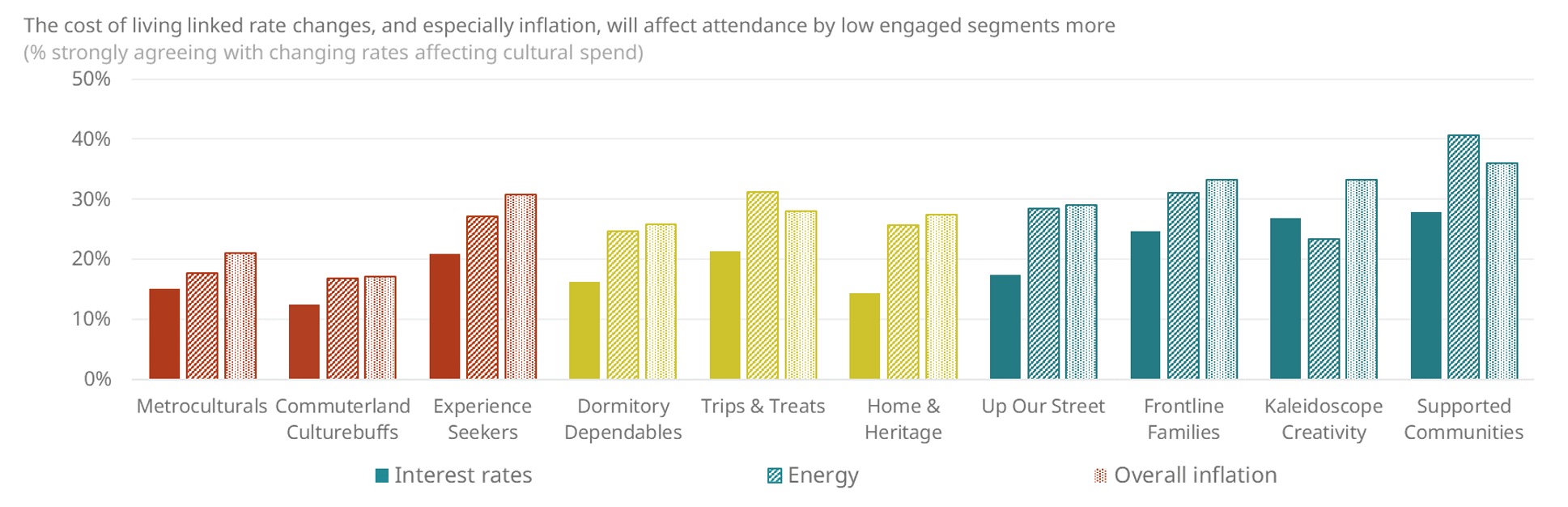

Most Audience Spectrum segments feel that energy and inflation are causing them greater concern than interest rate hikes, and will have the greatest impact on their leisure spending, though this does vary between groups:

- The already least culturally engaged audiences continue to be the most affected, compounding the existing inequality gap in cultural consumption.

- Groups with children at home or other dependents are most put off attending arts and culture by the demands of rising energy bills.

- While Gen X (45-64) and Baby Boomer (65+) dominated suburban groups' attitudes to leisure spending are significantly less impacted by interest rates, having partially or fully paid off their mortgages.

Related videos

Cultural Participation Monitor | Latest Findings on Audience Attitude and Behaviours | Wave 9

Watch nowOther findings from Wave 9 | Jul 2023 | Live/digital, social values. audience behaviour

-

Cost of Living

It’s no surprise that the UK population feel worse off than they did last year (33% feeling worse off, 49% about the same and only 18% better off, a net 15% reduction).

-

Audiences prefer live events to digital

This report uses data from wave 9 of the Cultural Participation Monitor (CPM) to understand the extent audiences engage with live versus digital events, finding that:

- All audiences prefer live events, followed by at home viewing and then watching at a cinema screening.

- Lower engaged segments are more open to viewing at home and at the cinema compared to higher engaged segments.

- Younger people are more open to all viewing platforms and artforms compared to audiences aged 45 and over

-

Audiences prefer live events, but how much varies by artform

Data from the CPM suggests that the more popular an artform is the more open audiences are to viewing it in different formats other than live. This report presents insights into how the popularity of an artform and the initial audience interest can determine how engaging people find non-live events for a particular artform.