Cultural Participation Monitor

Cultural Participation Monitor

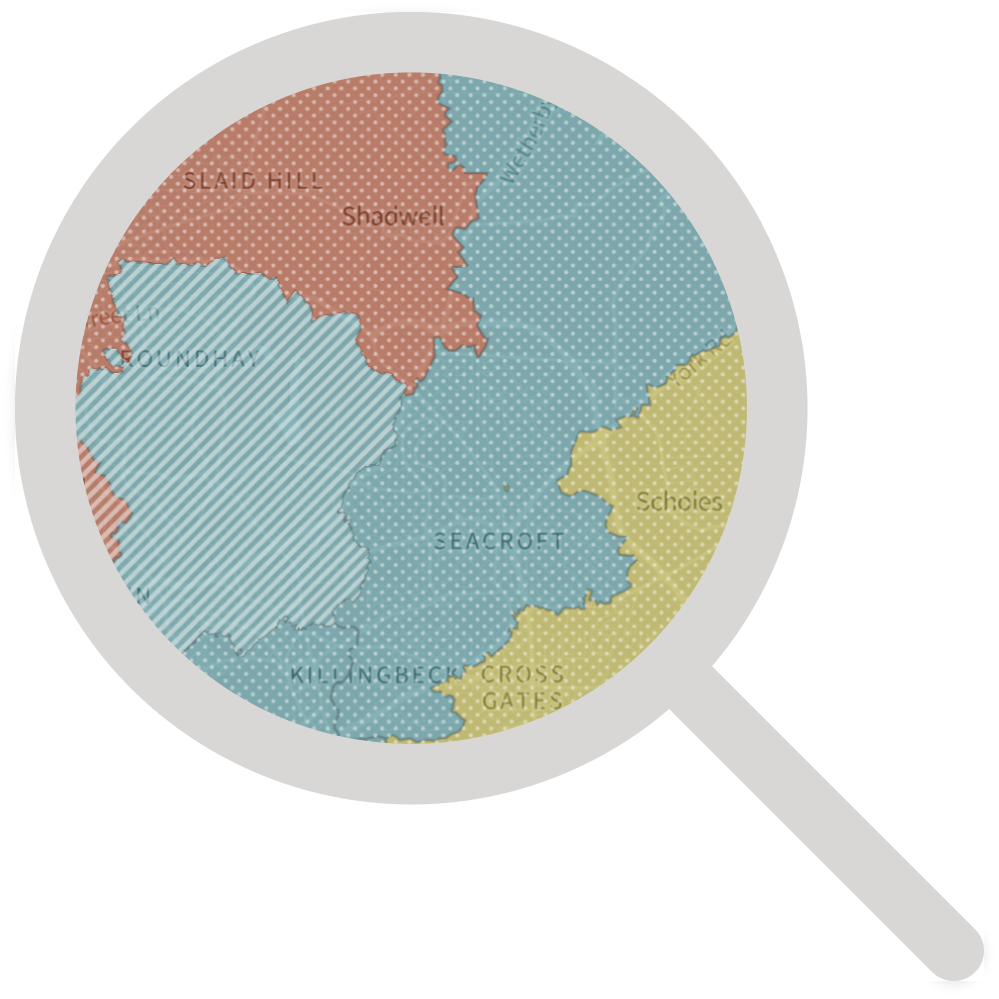

The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the pandemic and beyond.