Use of social and digital by Audience Spectrum

July 2024

This research is from The Audience Agency's nationwide longitudinal (ongoing) panel survey of changing views about participating in creative and cultural activities through the recent and ongoing crises, and beyond, the Cultural Participation Monitor.

Contents

Themes

Use of digital media and digital varies between Audience Spectrum, suggesting different potential routes to reach different segments.

For context, here are the overall levels of use of different channels and platforms:

WhatsApp, Facebook (still) and YouTube are by far the most popular, with TikTok having overtaken X/Twitter and Instagram having pulled away towards the more widely used sites. Finally, Pinterest takes up the rear, although (along with TikTok) it shows particular wide differences in use by segment.

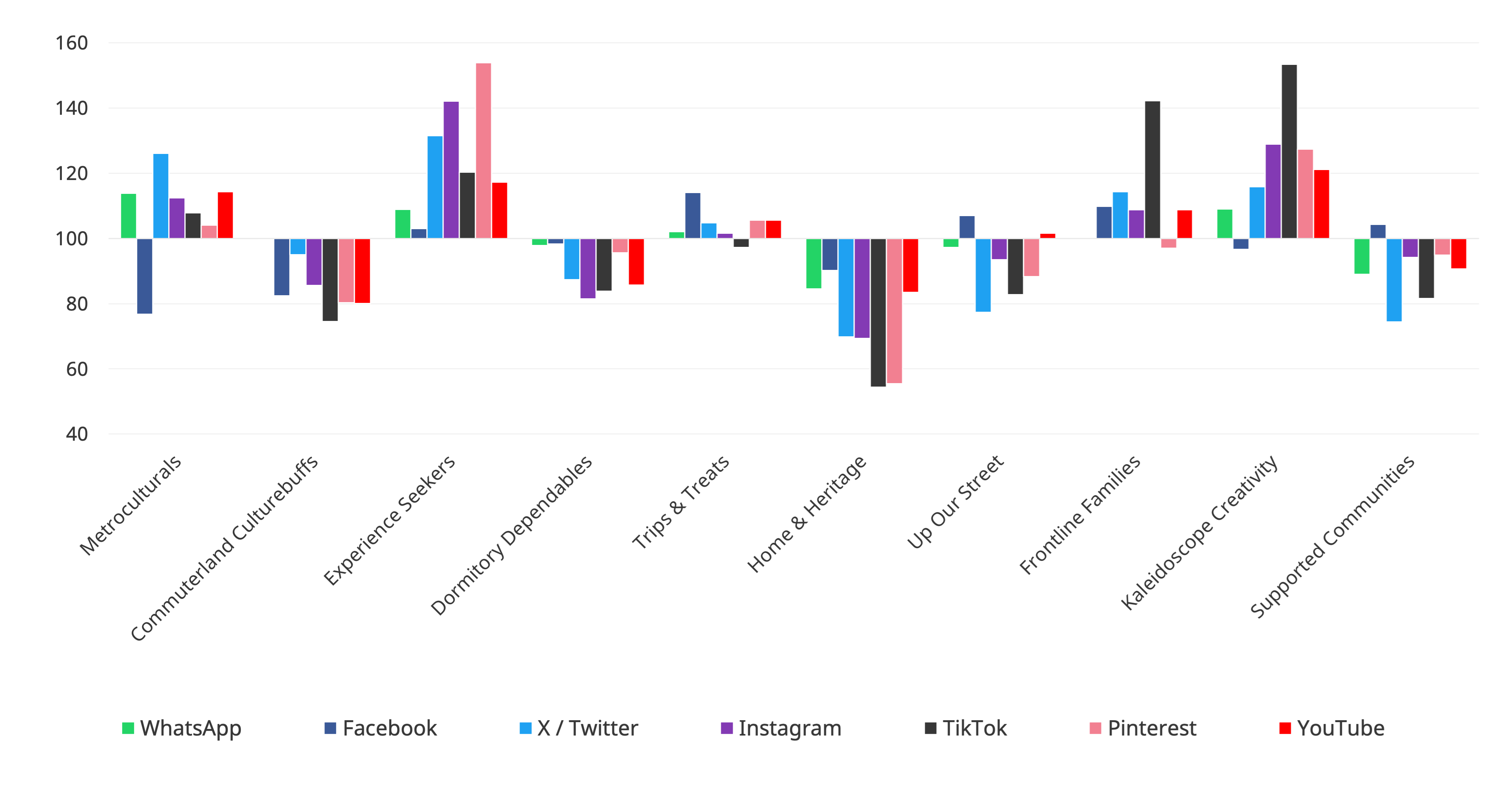

Using those percentages as a baseline (indexed to 100), we can see the relative difference for different segments:

There is a notably varied picture by segment, which can be grouped as follows:

Metroculturals: Lowest of all segments for Facebook, but higher for X/Twitter than for other channels.

Commuterland Culturebuffs / Home & Heritage: Lower for (almost) all channels, especially the latter segment and especially for TikTok. Home & Heritage are lower across the board, especially for Pinterest as well, but also much lower for X/Twitter and Instagram. Commuterland Culturebuffs are only slightly below average for X/Twitter and average for WhastsApp.

Experience Seekers / Kaleidoscope Creativity: Both are above average for all sites and platforms except for Facebook. Experience Seekers are particularly high for Instagram and Pinterest (as well as X/Twitter, which as higher proportion of them use than any other segment). Conversely, Kaleidoscope Creativity is particularly high for TikTok.

Dormitory Dependables / Up Our Street / Supported Communities: All of these groups are below average for all sites and platforms, although the latter two are slightly more likely to use Facebook and substantially less likely to use X/Twitter (Dormitory Dependables are very slightly below average for both). Otherwise the difference is that Up Our Street is slightly up for YouTube use and Dormitory Dependables markedly lower than the other two for Instagram.

Trips & Treats: This groups is close to, or slightly above, average for all sites and platforms, with Facebook the one that they are more likely to use than any other segment.

Frontline Families: This segment is moderately above average for all sites and platforms except WhatsApp and Pinterest, other than a particularly strong likelihood to use TikTok (over 40% more likely than average, second only to Kaleidoscope Creativity). This represents a strong shift since the groups was originally named in response to its particularly high use of Facebook (when they were called Facebook Families).

Using this information

These sites all behave differently (e.g. in terms of content, algorithms, advertising), so this isn’t just a case of ‘which to target’. For example, TikTok might be a better target for Frontline Families and Kaleidoscope Creativity than other segments, but it doesn’t have targeted display advertising in the same way as Facebook, so often relies on creation and promotion of shareable content. Likewise, YouTube is an effective platform for those with engaging video content (as many cultural organisations will) but can be used for a combination of direct (pre-roll) advertising and to promote content which an audience may directly choose to view and share.

Even where a segment is below average, it may still be worth using the platform, based on its reach and features (e.g. a majority of Home & Heritage use Facebook, even if they use it less than others and it allows geographical and keyword targeting that may be helpful for identifying members of this group).

WhatsApp isn’t directly an advertising channel, or one that you’d (probably) want to use for direct communication with closed groups of audiences (although even saying this suggests counter-examples: to give a supporters group exclusive access to artists and creative staff perhaps). However, it’s notable that such a high proportion of audiences are using the app, especially among some of the highest-engaged groups. It may be worth exploring how to promote content that is easily reshared via WhatsApp, or to help to establish networks of supporters on the app that you can then ‘feed’ with content, offers and information, or use as a network for promotion and support.

This information can, therefore, be used in a variety of ways depending on circumstances, but should be a useful addition to understanding different segments’ wider behaviours and interests, as well as directly, in terms of advertising, promotion and communication channels.

Other findings from Wave 10 | Mar 2024 | Places. event timings, heritage, social & digital

-

Opinions on the display of human remains in museums

Debate about the display of human remains has been in the news recently, here's what our research found.

-

Interest in history and heritage

Heritage is broadly popular with the general population, with high proportions saying that it’s an interest of theirs.

-

Attitudes to heritage

We asked the extent to which people agreed or disagreed with a range of statements about history and heritage, to better understand the attitudes which people bring to their engagement. These results were surprising in a number of ways: neither consistently conforming to a traditional nor a progressive perspective.